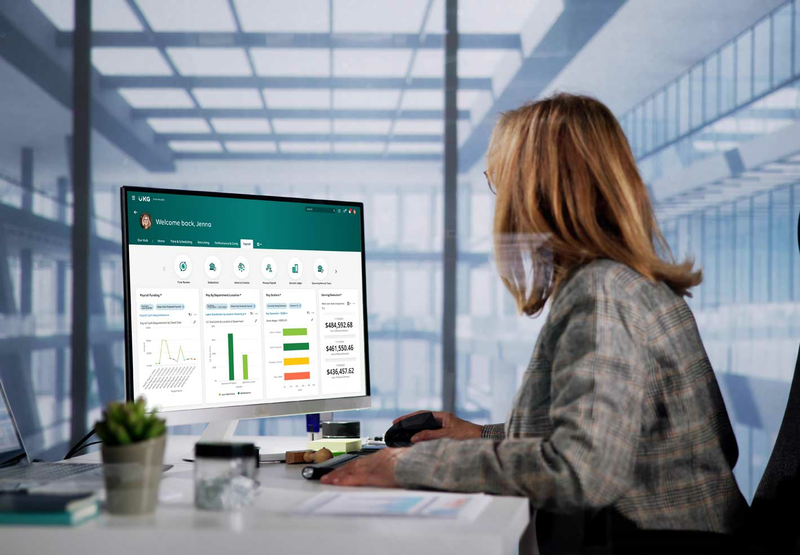

Purposeful HR that empowers leaner teams.

UKG Ready® is an all-in-one HR and payroll software for businesses looking to increase efficiency and simplify compliance.

Purposeful HR that empowers leaner teams.

UKG Ready® is an all-in-one HR and payroll software for businesses looking to increase efficiency and simplify compliance.

A culture-driven HCM solution that inspires your people.

The powerful UKG Pro® HCM suite drives business results for people-focused organizations.

Every organization wants to deliver perfect checks on every payroll run. But how can you achieve payroll accuracy and solve year-end challenges if you’re still relying on outdated payroll technology? Legacy payroll software lacks several advanced features and capabilities that improve payroll efficiency, accuracy, and compliance including:

Support your payroll team, your people, and your culture with modern and scalable technology to meet your business needs.

Changes and updates from federal, state, local, and regulatory agencies should be automatically updated to the payroll system in a timely manner. In addition, reporting capabilities and a full audit trail should be integral to the payroll application, providing on-demand access to audit compliance data when needed. UKG Payroll Software can help reduce the risk of errors and costly penalties with regular system updates and robust reporting to help you always remain compliant.

Workflows and checklists within the payroll software system help the payroll team stay in sync, reduce errors, and cut down on administrative time involved in using manual and separate worksheets to track the payroll process. With UKG Payroll Software, extensive workflows can be configured along with real-time payroll processing reporting so that you have complete insight at every step of the process.

Mobile and self-service tools empower employees to enter data such as W-4 and direct deposit information, address changes, and state and local tax changes on their own — saving the payroll team significant time and effort. With the UKG mobile app, employees can check their pay on the go, make changes to their information at their convenience, and see how payroll and benefit changes can affect their next paycheck, all integrated with UKG’s Payroll Software.

Ensure accurate and on-time pay by streamlining and automating complex processes.

Payroll processes like running payroll, precheck reporting, data loads, file feeds, post checks and more can be cumbersome and daunting if manual checks are in place. UKG payroll software streamlines complex processes by automating workflows, limiting manual errors and saving time and money. Remaining compliant can be difficult with several federal and state mandates, updates to tax rates, and new laws. If missed, this can result in costly fees and can take time to bring a system up to date.

With automated compliance and system updates, you’ll reduce the need for customization and enables native audit trail reporting. Having visibility into your payroll while its processing can save time and reduce costly errors. UKG payroll software contains multilevel security and access for different groups, which means that managers, operations, and business leaders can schedule and view their own reports with varying levels of detail and make informed, data-driven decisions.

Payroll software manages how you pay your employees. This software helps organize and automate the payroll process by calculating paychecks, tracking expenses, monitoring employee hours, and more.

Payroll software automates the most labor-intensive aspects of running payroll. It can:

Payroll software can significantly assist you in staying compliant with various regulations and requirements. Here’s how:

See how UKG Pro can help you retain employees, maintain compliance and streamline the payroll process.

See how to gain the insight, evidence, and support you need to make a persuasive case with decision makers for a modern HR and payroll technology solution.

This article reprint from APA PAYTECH offers insight and best-practice areas to consider when you’re looking to modernize your organization’s payroll systems.

Create great workplaces for all with our HR, payroll, and workforce management solutions.